Oh... my... gosh... did all the Crypto creators simply watch Sneakers (1992) and conclude that instead of the Utopian vision of destroying the financial system and making all peoples equal they would use "THE ITEM" to make themselves the New Economic Aristocracy?

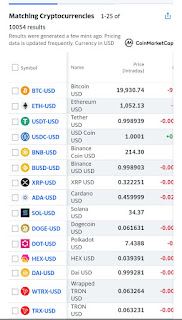

BitCON, the largest of the crypto scams, is currently hovering under $20,000 per Chuck E. Cheese token. To those deeply invested in the scam this represents an 800% increase! If you invested in 2014 well you might have hit a jackpot. Of course if you did not invest prior to 2017, well then you lost real money to this ponzi scheme."You know it doesn't work?"

"That's really not important, is it?"

Wyoming Senator Cynthia Lummis, who owns $100-$300 thousand in Bitcoin wants to get pensions and other real money moved into the crypto investment scam to solidify and advance her position. Sadly, Wall Street Senator Kirsten Gillibrand joined Lummis in the goal of crafting a bill to let crypto steal real money.

Additionally, the Commodities Futures Trading Commission on Thursday charged Mirror Trading International and the firm's owner, Cornelius Steynberg, with fraud, claiming the company operated as a fraudulent multi-level marketing scheme that scammed billions from investors.

What we are seeing now is the next stage of the con wherein the scammers need new influxes of cash to remain solvent while continuing to post "real" gains. All the original money from the super early adopters and the giddy initial gamblers can't keep propping up the inflated "value" of the Ponzi scheme.

No comments:

Post a Comment